what is the property tax rate in ventura county

Thousand Oaks includes Newbury Park and Ventura area of Westlake Village. The median property tax on a 56870000 house is 335533 in Ventura County.

Ventura County Ca Property Tax Search And Records Propertyshark

Uni SCH Bond Oakpark 2.

. Uni SCH Bond Oakpark 4. Uni SCH Bond Oakpark 4. For example if a company earned 100000 and paid 25000 in taxes the effective tax.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. Santa Monica - 1113924. 10400 City Property Tax Rate Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400 Westlake Village LA.

The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Tax description Assessed value Tax rate.

These percentages are based on the highest tax rate for the assessed value of homes in each city. This is the total of state and county sales tax rates. It does not account for direct assessments for services such as lighting sewage refuse and others charged by cities.

7 rows Property Tax Rate. The Ventura County sales tax rate is 025. Annual secured property tax bill that is issued in the fall is based on ownership and value as of this date.

Tax Rates and Info - Ventura County. The median property tax on a 56870000 house is 597135 in the United States. First day to file affidavit and claim for exemption with assessor but on or before 500 pm.

The Ventura County sales tax rate is 025. The property tax rate in the county is 078. Uni SCH Bond Oakpark 3.

Ventura County collects on average 059 of a propertys assessed fair market value as property tax. West Hollywood - 1179221. The most straightforward way to calculate effective tax rate is to divide the income tax expenses by the earnings or income earned before taxes.

The California state sales tax rate is currently 6. Tax Rate Database - Ventura County. What is the real estate tax in.

Similarly what is the. The combined 2020 sales tax rate for Ventura County California is 725. Fortunately for the state and the services that rely on our tax money four things can trigger a re-assessment of the propertys value.

Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of median property taxes. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of 059 of property value. The combined 2020 sales tax rate for Ventura County California is 725.

The median property tax on a 56870000 house is 420838 in California. The California state sales tax rate is currently 6. This is the total of state and county sales tax rates.

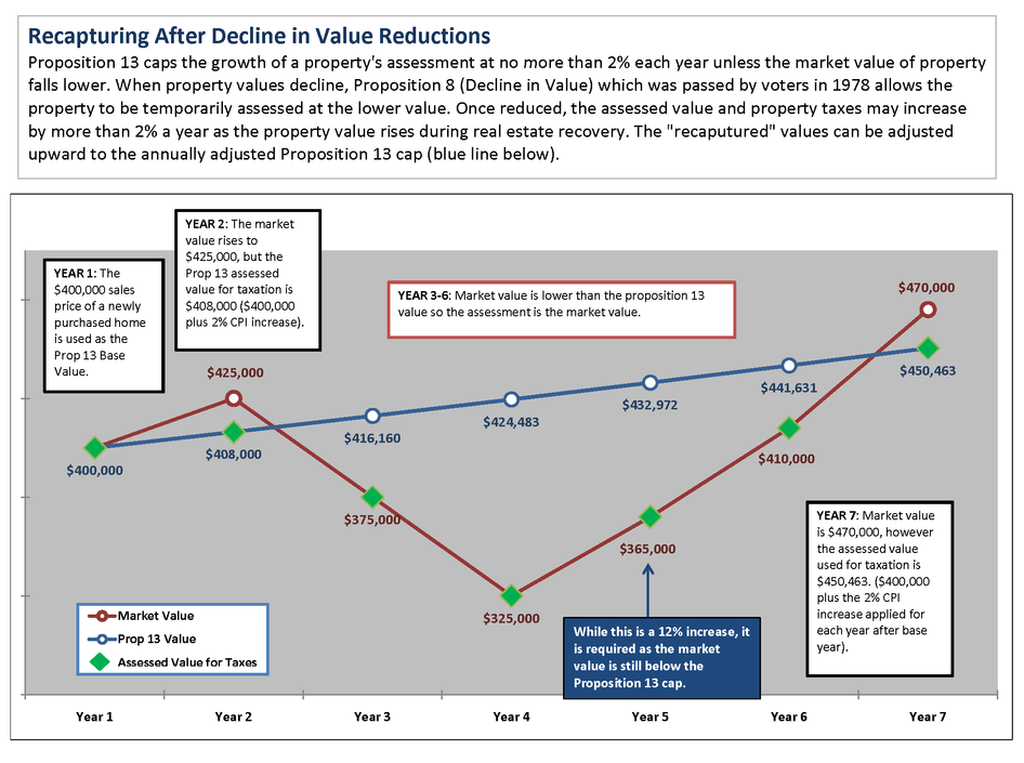

The tax cannot exceed 1 of a propertys assessed value plus bonds and direct assessment taxes and increases in assessed value are limited to 2 annually. Prop 13 Maximum 1 Tax. Beside above how do you figure out tax percentage.

Consequently what is the tax rate in Ventura County. Los Angeles - 1220441. Taxes become a lien on all taxable property at 1201 am.

Beside this what is the property tax rate in Ventura County. Revenue Taxation Codes. What is the property tax rate in Ventura County.

Beverly Hills - 1087422. Click to see full answer. SEE Detailed property tax report for 5796 Freebird Ln Ventura County CA.

Ventura County Ca Property Tax Search And Records Propertyshark

Lansner Hiring May Boost Housing Outlook House Prices Housing Market Mortgage

Digital Cartography 68 Visualoop Los Angeles Real Estate Digital Cartography Rent

Ventura And Los Angeles County Property And Sales Tax Rates

Ventura Cpa Bill Soderstedt Storage Furniture Decor

When We Reach Retirement Age A Lot Of Us Plan To Move To That Dream State We Always Pictured Ourselves Growing Old Gas Tax Healthcare Costs Better Healthcare

Is The Property Tax In Texas Versus California A Deal Breaker If You Are Moving To Texas Quora

New Homes For Sale In Rosamond California Tour Our Well Crafted Homes In Rosamond Broker S Welcome Open House Invitation Open House New Homes For Sale

Pay Property Taxes Online County Of Ventura Papergov

Price Per Sf Cincinnati Google Search Inner City Graphing House Prices

Hire An Appraiser Loan Modification Line Of Credit Market Value

Commercial Real Estate Studio City For Sale Lease Ventura Boulevard Commercial Realtor Studio City

Ventura And Los Angeles County Property And Sales Tax Rates

Ventura And Los Angeles County Property And Sales Tax Rates

Ventura County Ca Property Tax Search And Records Propertyshark

Pay Property Taxes Online County Of Ventura Papergov

Ventura County Assessor Supplemental Assessments

Prop 8 Decline In Value And Prop 13 Property Tax Limits Ventura County

Ventura County Ca Property Tax Search And Records Propertyshark